With access to a company’s balance sheet, net working capital can be calculated simply by subtracting current liabilities from current assets.

Current Assets – Current Liabilities = Net Working Capital

But, what exactly is net working capital, and how are current assets and current liabilities calculated?

Net Working Capital Can Be a Sign of Strength

When evaluating the financial health of a business, a substantial positive balance in net working capital is a sign of strong liquidity and efficiency in operation. Lenders and investors know that if a company has plenty of working capital, there will be money left over after short-term obligations to pay long-term debts and to invest in growing the company.

…Or a Warning Sign

Potential financial partners also know that if a company’s current liabilities are greater than its current assets, the business will not have money for growth. Even a company with strong revenue can tie up too much money and interfere with cash flow. At worst, the company may be unable to pay creditors and could eventually face bankruptcy.

Let’s take a closer look at the terms that define net working capital, why it’s an important financial metric and how you can boost net working capital to strengthen your business.

Start with Current Assets

The current assets of a business, also referred to as short-term assets, include cash and cash equivalents, accounts receivable, inventory, prepaid expenses and investments.

This group of assets is referred to as current assets because they are either already in the form of cash or they can be converted to cash within the business year. They represent the most liquid assets of the company.

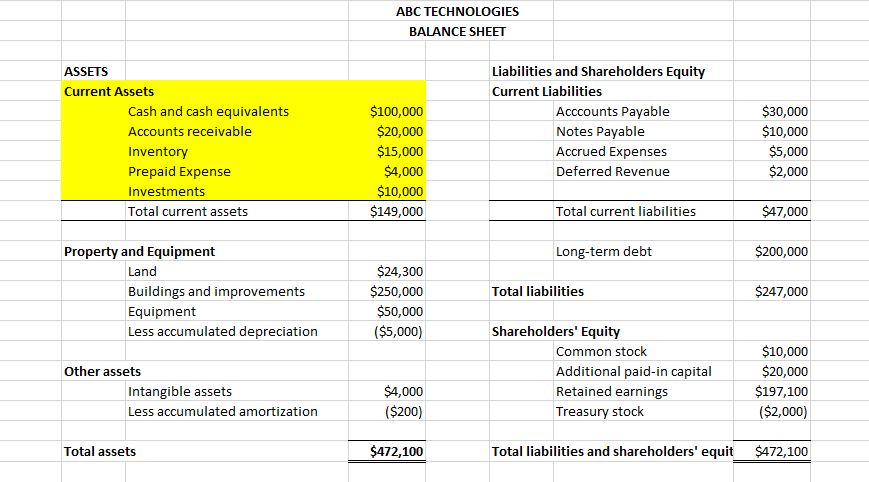

Current Assets Example

In the example below, the balance sheet for ABC Technologies shows current assets of $149,000.

Subtract Current Liabilities

The current liabilities of a business, also referred to as short-term liabilities, include accounts payable, notes payable, accrued expenses and deferred revenue.

Again, this group of liabilities is referred to as current because they must be paid within one year or within one operating cycle of the business. An operating cycle, also referred to as a cash conversion cycle, is the time it takes the company to purchase inventory and convert it into cash receipts.

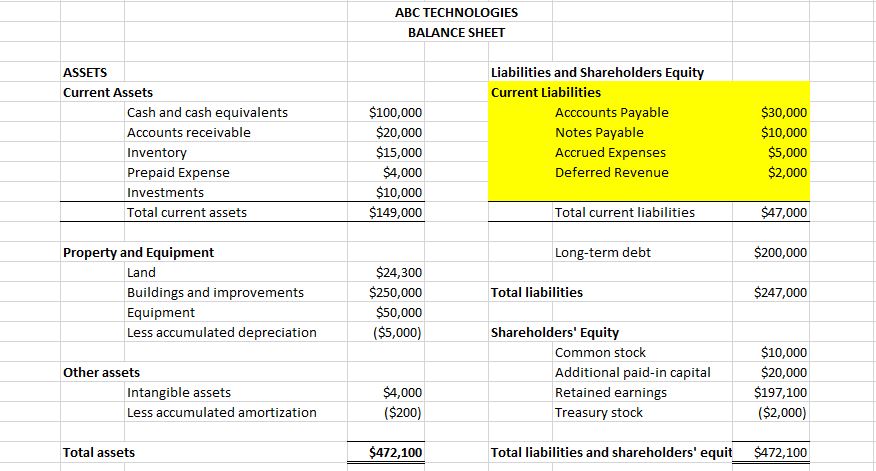

Current Liabilities Example

In the example below, the balance sheet for ABC Technologies shows current liabilities of $47,000. Accordingly, ABC Technologies has net working capital of $102,000.

$149,000 (current assets) – $47,000 (current liabilities) = $102,000 (net working capital)

Why is Net Working Capital Important?

If you own or manage a business, knowing your net working capital is important because it provides a way to monitor the company’s underlying financial health; something like stepping on a scale or checking your blood pressure.

Who Else Uses the Net Working Capital Formula?

When a supplier is asked to extend trade credit, a banker is considering a loan or an investor is weighing the risk of an investment, calculating a company’s net working capital is a sure and simple way of checking the liquidity of the business, which is a primary factor in determining its ability to repay short-term financial obligations.

A Track Record of Positive Net Working Capital

When financial partners are considering a potential relationship with a business, they want to feel confident that the business always maintains positive net working capital, ensuring the ability to pay supplier invoices, grow the company and make loan payments on time.

A banker or investor may want to review several years of financial statements, checking net working capital to evaluate whether the liquidity of the business is trending toward strength or weakness. Steady improvement in working capital shows that a company is being managed with more economy and efficiency. A steady decline shows that the business may be headed for trouble.

A Sign that a Company is Ready to Grow

For investors, a substantial reserve of net working capital is also a sign that a business has the capacity to grow if presented with the opportunity. Although business growth requires effective management of many beneficial elements, access to adequate working capital for hiring, stocking and scaling up is a critical growth factor.

In some cases, the trend can say more about a business than the net working capital balance. A business with a negative net working capital balance that is trending upward from year to year is likely to be viewed as more financially secure than a business with a positive net working capital balance that is trending downward over time.

How to Grow Your Net Working Capital

Collections and payments are the elements of cash flow that have the most direct and immediate impact on net working capital. The more closely you manage the amounts and frequency of these cash flows, the more control you will have over growing your net working capital.

Higher Net Working Capital from Accounts Receivable

To the extent possible, keep your customers on Net 30 or pre-payment terms. Large accounts will insist that they deserve longer terms, but you should keep their loyalty with your quality and service, not by acting as their banker. When you must give longer terms, agree to do so only at a higher price.

Insist on timely payment. Call customers as soon as they are past due. If they make a habit of paying late, change terms to pre-payment. Slow payers will pay on time or will go elsewhere – either of which will be good outcomes for your working capital.

Take care to avoid bad debts. Get credit references and financial statements before accepting a large order. Even a COD is not safe if you invest your labor and material only to receive nothing in return.

Higher Net Working Capital from Inventory

Keep inventory lean and moving. Cash tied up in idle material has no value and will require more spending before you can invoice. Ask suppliers to send goods on consignment to swap space for time and money. If you have unused inventory, negotiate with suppliers to accept the return of the material.

Require your suppliers to compete. When quality and service are comparable, vendors should be willing to entice you with lower prices and better terms.

Use every opportunity to speed up collections and slow down payments. When you ship, invoice immediately. When you purchase, don’t buy until you must. When you pay, use all the time allowed and take any available discounts.

Higher Net Working Capital from Productivity

All improvements in productivity have a downstream effect on net working capital. Many new businesses try to be all things to all customers, and they soon find that this is a drain on time and resources. By narrowing its product or marketing focus, a business can concentrate on the most active customers, the most profitable products and the most efficient methods.

Changing technology offers frequent opportunities to save time, conserve cash and work more efficiently. In recent years, remote work, virtual trade shows, freight innovations, 3D printing, robotics and advanced AI have completely changed the nature of work in some industries.

There is more cash to be recovered in the energy footprint of a business. Breakthroughs in lighting, plumbing and HVAC mean smaller checks to the utility companies, less pollution and more in the bank for working capital.

Keeping Working Capital Secure

Top companies also keep their working capital secure by focusing on safety and quality. A single work accident can be financially devastating, and the costs of poor quality can slowly drag down customer satisfaction, production yields, reputation and pricing.

Remember the Net Working Capital Formula: CA – CL = NWC

For a quick way to measure the financial health of your company, or to determine the level of risk in extending credit to a potential partner, remember how to calculate net working capital:

Current Assets (CA) – Current Liabilities (CL) = Net Working Capital (NWC)

Still have finance questions?

No matter your business needs, Higginbotham is here to help. Learn about our business insurance policies and HR payroll services to help you manage financial risk and talk to a member of our team today.